Visit Nashville and you’ll catch a glimpse of the future — provided you’re wearing proper protective equipment.

Visit Nashville and you’ll catch a glimpse of the future — provided you’re wearing proper protective equipment.

In 2015, the founders of Hirebotics wanted to meld their expertise in robotics, software and cloud computing. They found their niche in the welding industry, creating programs that empower welders to teach robotic arms using a smartphone.

As the company grew to eight employees with an international customer base, Hirebotics began looking for investors to support the company’s evolution. With the help of SBF along the way, Hirebotics announced its acquisition in March by Sverica Capital Management, a Boston- and San Francisco-based private equity investment firm.

CEO Rob Goldiez talked about long-term relationships in the business world, choosing the right buyer for your company and what it’s like attracting interest from Shark Tank’s Mark Cuban.

Hello, world

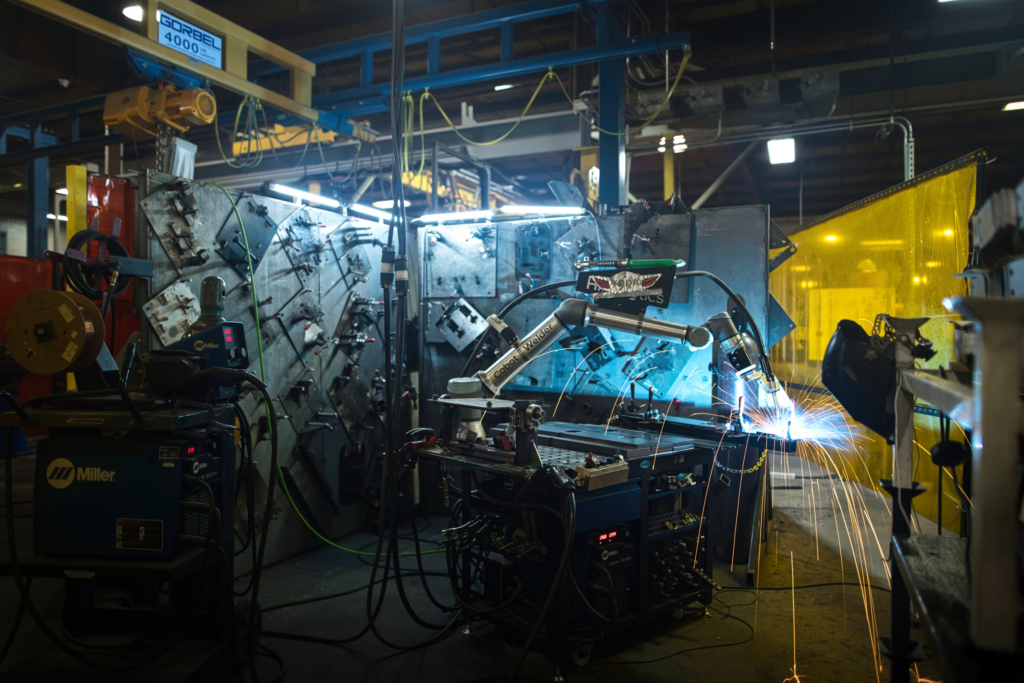

Generic robot arms are affordable and accessible to many manufacturers, but getting them to do what you want can present a barrier. That’s where “cobots,” the collaborative robots at the heart of Hirebotics’ business strategy, come in.

“Teaching sounds less intimidating than programming, right?” said Goldiez. “Programming sounds like I’ve got to write code.”

To solve for this, Hirebotics developed software that clients can intuitively use to communicate with robotic components through an app. Rather than relying on a specialized interface, the Hirebotics system works through an ordinary smartphone. “The app is so easy to use, the clients can teach their robots themselves,” said Goldiez.

In the beginning, the Hirebotics team took on a wide variety of custom design work, selling its communication channels across multiple kinds of industries. Welding turned out to be a perfect fit for their software and for their business aspirations. With their new focus, Hirebotics turned its attention to building a standard product that could help the company grow.

Picking a winner

The next few years saw massive success for Hirebotics. “We were tripling the business every year,” said Goldiez, particularly after a profile-raising 2017 feature in The Washington Post. That story caught the eye of mega-investor Mark Cuban, who participated in a round of fundraising. By the summer of 2022, Goldiez and his cofounders had invested significant portions of their own net worth in Hirebotics. They began looking for ways to buy out their outside investors and mitigate the financial risk they’d personally assumed, in addition to growing the company’s liquidity — a process called majority recapitalization.

Throughout the company’s development, SBF had been working closely with Hirebotics. With the help of SBF partner Rich Franz (a longtime friend of Goldiez) and SBF Knoxville’s Alexia Pappas, Hirebotics began the process of choosing the right investor. “It’s really a question of who do you like and who do you feel you could get along with,” Goldiez said. “In the end, it was fairly clear to us that Sverica was the right fit, not because they were the highest bidder, but because we felt they would be good partners for the future.”

Selecting a new equity partner for a company is, at its heart, a funneling process. The earliest stages saw Hirebotics reach out to about 150 possibilities. Often, candidates self-select out if they’re not an obvious match. “Then it gets down to 12 or 15,” Goldiez said, “and gets whittled down from there.”

In the latter stages of seeking an acquirer, when potential investors ask for more and more detailed information, a close relationship with an accounting firm pays huge dividends. SBF also helped with due diligence needs through multiple outside valuations. “Having that long relationship with SBF helped so much,” Goldiez said. “From a credibility standpoint, having your accountants involved with the process is major.”

Words of advice

With private equity backing Hirebotics, a lot of new options are now on the table for the company. “We got the business to a certain point with a small team of eight,” Goldiez said, “but there are other applications that can use our technology, robotics and software. There’s hiring to think about. There are markets outside the U.S., Canada and Australia, where we primarily operate, that want to use this technology. Sometimes the best way to accomplish something is not organically, but through acquisition. Sverica can help accelerate that.”

Goldiez described the sale process, which took about eight months, as “emotional” and “grueling.” at times.

“You get all sorts of questions from buyers about industry segments and markets, customer satisfaction, valuations,” he said. “You might think you know your business and you don’t. Depending on the company size, I would strongly recommend hiring an investment banker, and having a quality accounting firm that knows your business. Really getting to know what the business is worth cannot be understated.”

Even if finding investors sounds far in the future for your business, Goldiez says there’s no time like the present to prepare for that kind of growth. “Don’t wait until you need to get your books in order,” he said. “Have someone from accounting plugged in early that knows your business. That way, when you’re ready, things are just ticked and tied.”